Term life insurance is a crucial financial tool that helps protect your loved ones by providing essential coverage in key areas. One of the main aspects of term life insurance is its ability to address specific financial needs, primarily covering debts. In this article, we will explore how term life insurance can help cover your debts, focusing on two key types: mortgage and auto loan.

Covering Your Debts with Term Life Insurance

Covering debts is one of the fundamental reasons people opt for term life insurance. Debt can place a significant financial strain on your family if something were to happen to you. By having a term life insurance policy, you can ensure that obligations like mortgages and auto loans are taken care of, offering peace of mind and financial security to your loved ones.

Mortgage

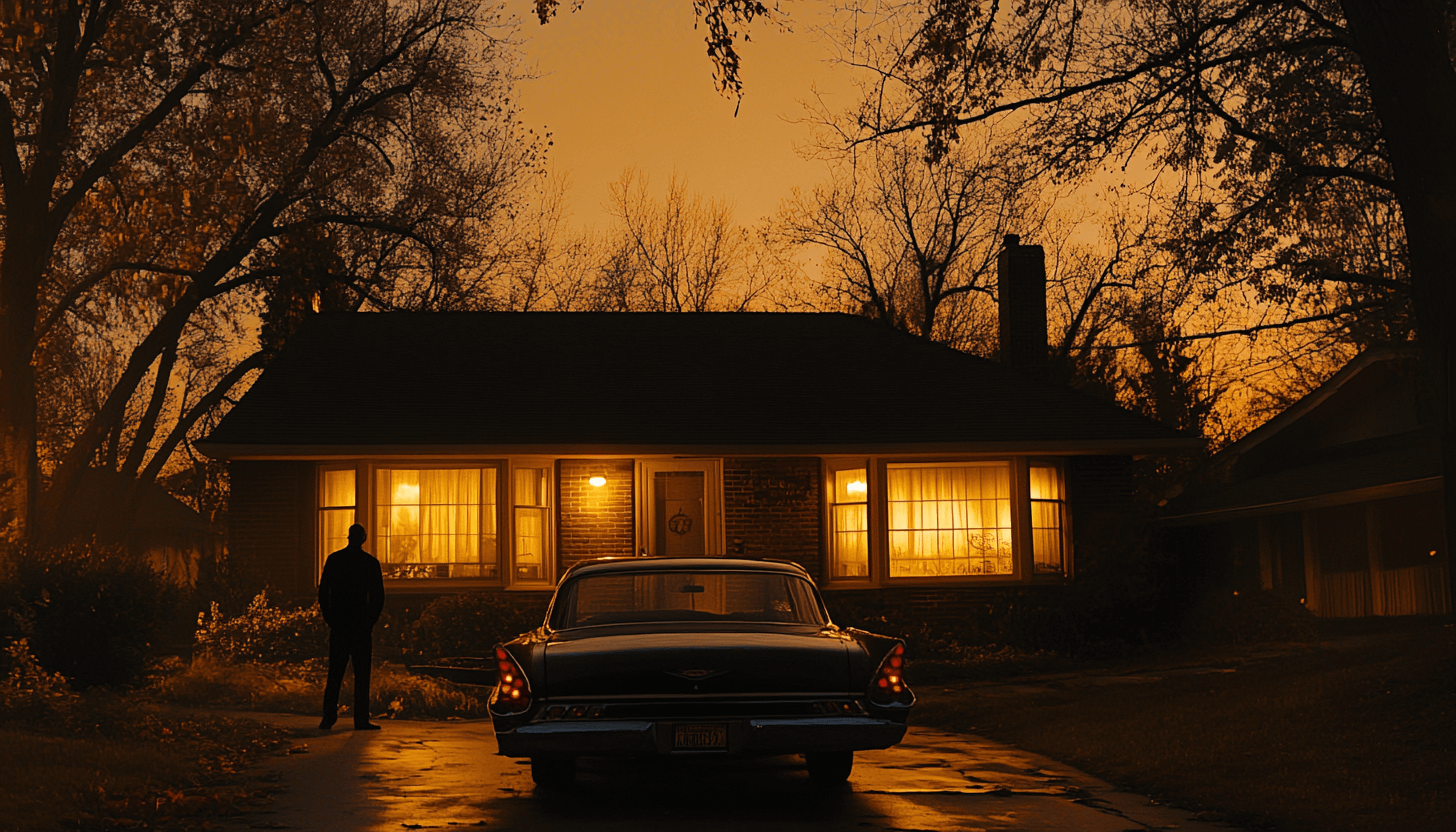

One of the most substantial and common debts people face is a mortgage. A house is often the largest purchase someone makes in their lifetime, and paying off a mortgage can take decades. If the primary breadwinner in a family were to pass away, the mortgage payments could become an overwhelming burden.

Term life insurance can play a critical role in such circumstances. By having a policy that covers the remaining mortgage balance, you can help prevent your family from facing the risk of foreclosure. This allows them to maintain stability and continue living in their home without the additional stress of financial insecurity.

Real-life statistics show that mortgage debt often takes up a significant portion of an average family’s monthly expenses. According to the Federal Reserve, the median mortgage debt for U.S. homeowners is around $137,000. By having term life insurance, this debt can be covered, ensuring your family isn’t left struggling to keep up with payments during an already difficult time.

Auto Loan

Another common form of debt that term life insurance can help cover is an auto loan. Many families rely on vehicles for daily transportation, whether it’s commuting to work, taking kids to school, or running errands. Losing a family member with an outstanding auto loan can create both emotional and financial hardships.

Term life insurance can cover the outstanding balance of an auto loan, relieving your family from this financial obligation. The average car loan in the U.S. is approximately $31,000, a significant amount for most families to manage suddenly. By including this debt in your term life insurance policy, you can help reduce the financial impact on your loved ones.

Real-life scenarios where auto loans burden a family can be numerous. Suppose a family has two vehicles with significant loan balances. If the person responsible for these debts passes away, managing these costs would add to the emotional stress. Term life insurance helps prevent your family from facing these financial challenges alone.

Conclusion

Term life insurance serves a critical role in providing financial security by covering debts such as mortgages and auto loans. By addressing these key areas, term life insurance can help protect your loved ones from the burden of significant financial obligations during an already challenging time. Considering term life insurance not only offers peace of mind but also ensures that your family’s financial future remains stable.

If you haven’t already considered a term life insurance policy, now is an excellent time to do so. Assess your debts, including your mortgage and auto loans, and discuss with an insurance advisor how term life insurance can be tailored to meet your specific needs. Don’t leave your family’s financial future to chance—protect them today with term life insurance.